Hardcore shops reinvent themselves in the face of the crisis

Will the health crisis get the better of the shop? The reconfiguration is a new blow for physical commerce. A few weeks before the end of the year celebrations, the closure of "non-essential" shops could cause retailers to lose up to 60% of their annual turnover, according to the Conseil du Commerce de France. This is particularly the case in sectors that are suffering the full force of competition from pure players, led by Amazon (clothing, cultural products and games and toys).

"We are expecting a drop of 50 to 70% in our in-store sales, whereas we usually achieve 50% of our turnover between 15 November and 20 December," says Philippe Gueydon, managing director of the King Jouet group. To compensate for these losses, the company has set up a complete digital system at its points of sale (collection of purchases paid for online with the option of contactless, terminals with assisted sales, home delivery within 48 hours, etc.).

Although the context is very tense for local commerce, it would be hasty to sign its death warrant."Behind the 'retail bashing', there is the reality on the ground, which is different according to the territories and the type of shops", reminds Christian Dubois, director of the retail department at Cushman & Wakefield France.

Since 11 May, footfall has fallen by 25% to 35% in the town centres of tourist cities, but it has risen by 6% in out-of-town shops. As for shopping centres, they recorded an average fall of 15% over the whole territory. A lesser evil for malls where visitor flows have been reduced and space limited to 4 square metres per visitor.

Rationalisation of square metres

As a barometer of the health of the retail sector, rental values have not collapsed despite the more than 2 million square metres of retail space that have been the subject of arbitration or legal proceedings.The barometer of the retail sector's health, rental values have not collapsed despite the more than 2 million square metres of retail space that were subject to arbitration or judicial liquidation procedures in 2020 (Camaïeu, La Halle, Naf Naf, André, Orchestra-Prémaman, Alinéa, Bio c'Bon).

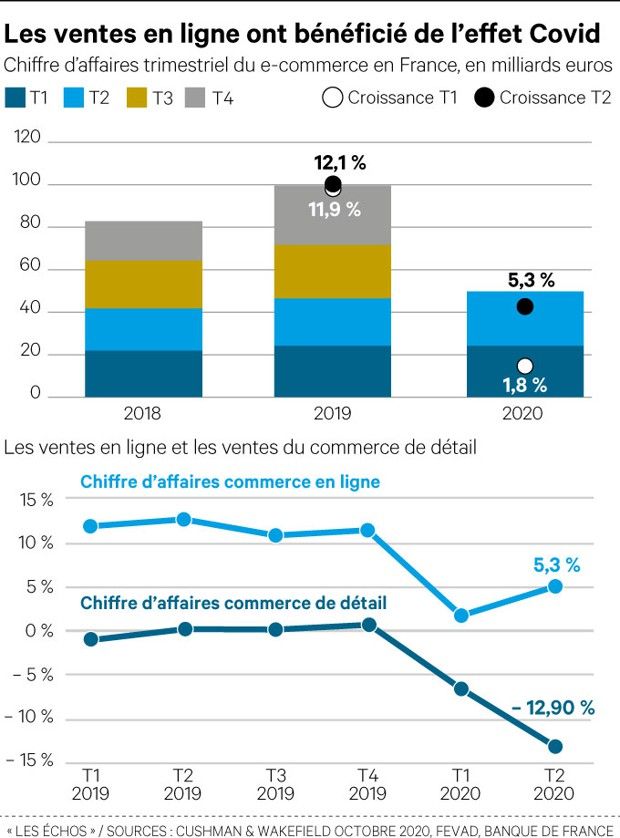

The resilience of the physical shop during the initial containment has relied heavily on the accelerated deployment of digital tools. According to Nielsen, the drive has increased by 150% over the period, and local retailers have developed click and collect systems in a hurry, which are now welcome.

"The crisis has confronted the retail sector with a full-scale digital crash test. In six months, the most technologically advanced retailers gained three years and those who had not started the process lost as much," observes Jean-Marc Megnin, managing director of ShopperMind (Altavia France group).